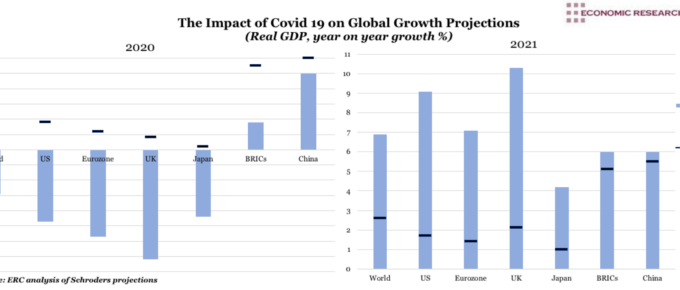

The combined hit to both demand and supply sides means that the COVID 19 recession will be a departure from the those seen in the 1930s and 2008: inflation is indeed likely. The risk is that the recovery may cause

The Impact of Covid 19 on Global Growth Projections

Researchers from Imperial College London predicting that ‘transmission will quickly rebound if interventions are relaxed.’. If this causes reintroduction of measures, then a double-dip recession looms. Indeed, should the spread of the virus maintain this pace, a sustained decline is

March 2020

The major drop in commodity prices and the unpopularity of mining is causing exploration to stop and mines to be shutting down. The economic crisis that is affecting raw materials, when the global economy starts to recover, is likely to cause rapid price increases. Inflation, which has been dormant now for many years, will probably be a hot

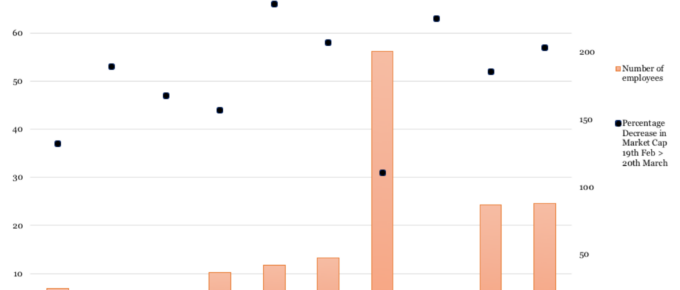

COVID 19: The Fate of Airlines

On Wednesday the US Senate passed the Coronavirus Stimulus bill, with little time for scrutiny. This is perhaps unsurprising, given the scale and urgency of the health, social and economic crisis gripping the United States. Importantly for the current administration, it appears to be unprecedented yet decisive action, the kind of presidential behaviour needed if Trump is to win a second term in office.

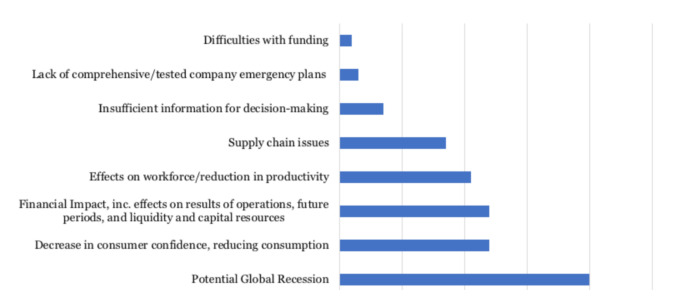

COVID-19: CFO Concerns

This economic crisis, as well as the virus, is truly novel- it is not caused by bursting financial bubbles, deficient demand or underutilised potential. Revenues that would normally come from the population producing, earning and

Holding of US Debt vs Export Sales of Selected Nations

Summary The graph shows the amount of US debt held compared to US export sales by country. It shows that Japan is currently the largest holder of US debt at $1122.9 billion and China the second largest holder at $1112.5 billion. The UK is the third highest for both US debt held ($341.1 billion) and […]