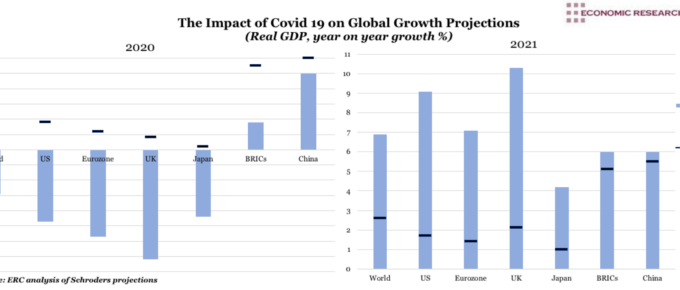

The combined hit to both demand and supply sides means that the COVID 19 recession will be a departure from the those seen in the 1930s and 2008: inflation is indeed likely. The risk is that the recovery may cause

The Impact of Covid 19 on Global Growth Projections

Researchers from Imperial College London predicting that ‘transmission will quickly rebound if interventions are relaxed.’. If this causes reintroduction of measures, then a double-dip recession looms. Indeed, should the spread of the virus maintain this pace, a sustained decline is

March 2020

The major drop in commodity prices and the unpopularity of mining is causing exploration to stop and mines to be shutting down. The economic crisis that is affecting raw materials, when the global economy starts to recover, is likely to cause rapid price increases. Inflation, which has been dormant now for many years, will probably be a hot

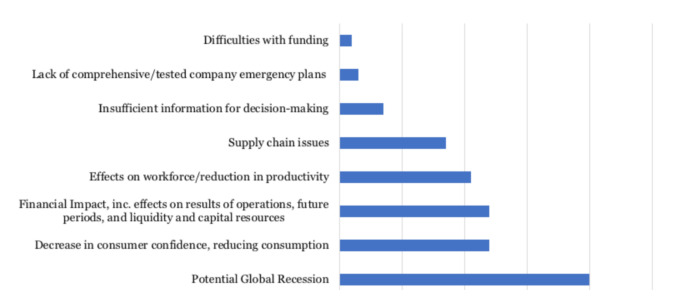

COVID-19: CFO Concerns

This economic crisis, as well as the virus, is truly novel- it is not caused by bursting financial bubbles, deficient demand or underutilised potential. Revenues that would normally come from the population producing, earning and

Ten Largest Global Economies: Happiness Index since 2015

Out of the countries shown, the UK is perhaps the most confounding. Over the data period it has experienced significant political upheaval and societal division, centered around the Brexit vote. In 2016, the statistics suggest that Britain actually became happier and has remained on this trend until the end of the data period…

10 Biggest Wealth Markets: 2018 Wealth vs Growth 2008-2018

As much as one could look to political differences or motivations, the single biggest boon for wealth growth has been global loose monetary policy with near zero interest rates and significant QE, which serves …