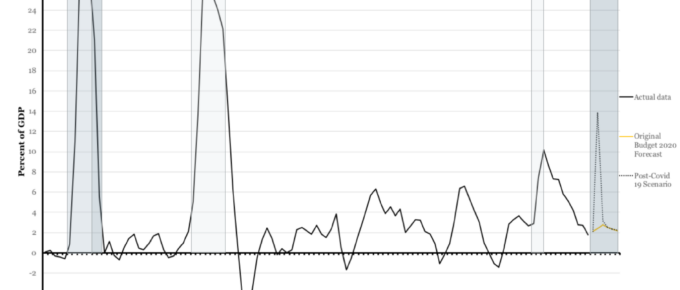

Despite the unprecedented and, as yet, incalculable, cost of government measures, the OBR have stated that ‘we can be confident that the cost of inaction would ultimately have been much higher.’.

COVID 19 and Inflation

The combined hit to both demand and supply sides means that the COVID 19 recession will be a departure from the those seen in the 1930s and 2008: inflation is indeed likely. The risk is that the recovery may cause

March 2020

The major drop in commodity prices and the unpopularity of mining is causing exploration to stop and mines to be shutting down. The economic crisis that is affecting raw materials, when the global economy starts to recover, is likely to cause rapid price increases. Inflation, which has been dormant now for many years, will probably be a hot

10 Biggest Wealth Markets: 2018 Wealth vs Growth 2008-2018

As much as one could look to political differences or motivations, the single biggest boon for wealth growth has been global loose monetary policy with near zero interest rates and significant QE, which serves …

UK Regions: Percentage of Degree-Educated Population vs GVA Growth

To varying extents, London has led the UK’s economic growth since the 1990s as a product of financial deregulation which not only boosted GVA but also served to attract more degree-educated …

GDP per Hour Worked and Labour Market Reforms

If anything is to be learned from the contrasting experiences of Germany and Greece, it is that there is rarely a policy in economics which is always correct or universally applicable…