Inflation has outpaced wage growth since the end of 2021, having a significant impact on the cost of living.

Chart of the Week

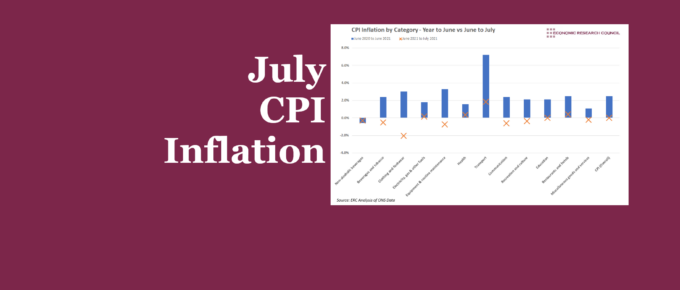

The rise in CPI to recent highs of 2.5% in June left many observers warning of persistent inflationary pressure. Nevertheless, the Governor of the Bank of England, Andrew Bailey, cautioned against overreacting to a ‘temporary’ jump in inflation. CPI figures from July seem to have justified his advice, with the headline year on year inflation rate falling to the government’s target of 2%. Despite this, the data strongly suggests that it is too early to claim victory.

March 2020

The major drop in commodity prices and the unpopularity of mining is causing exploration to stop and mines to be shutting down. The economic crisis that is affecting raw materials, when the global economy starts to recover, is likely to cause rapid price increases. Inflation, which has been dormant now for many years, will probably be a hot

Shrinkflation and the Importance of Measured, Honest Analysis

Caution must always be exercised when making definitive statements about economic developments, something especially true of unwieldy, nationwide aggregations of trends in markets as large and diverse as consumer goods. Headlines such as…

Chart of the Week: Week 30, 2017: Household Debt v.s. Interest Rates and CPI

The base rate climbed steadily to 5.5% in 2008 before the global financial crash, after which it plummeted to 1.5% within one year as the Bank attempted to stimulate investment and consumption.

Chart of the Week: Week 42, 2016: Inflation vs. Earnings

The latest ONS figures, released yesterday show that inflation seems to be in the initial phase of converging with wage growth, currently at a tolerable level.