Summary

According to the Inter-Departmental Business Register compiled by the Office for National Statistics, the number of businesses registered in the UK in Q2 2021 was 0.52% higher than at the start of 2020. Beneath the underwhelming headline figure exists variations between UK industries. In addition to this, the most recent data of births and deaths of UK businesses offers a useful insight as to how different sectors are reacting to the crisis.

What does the chart show?

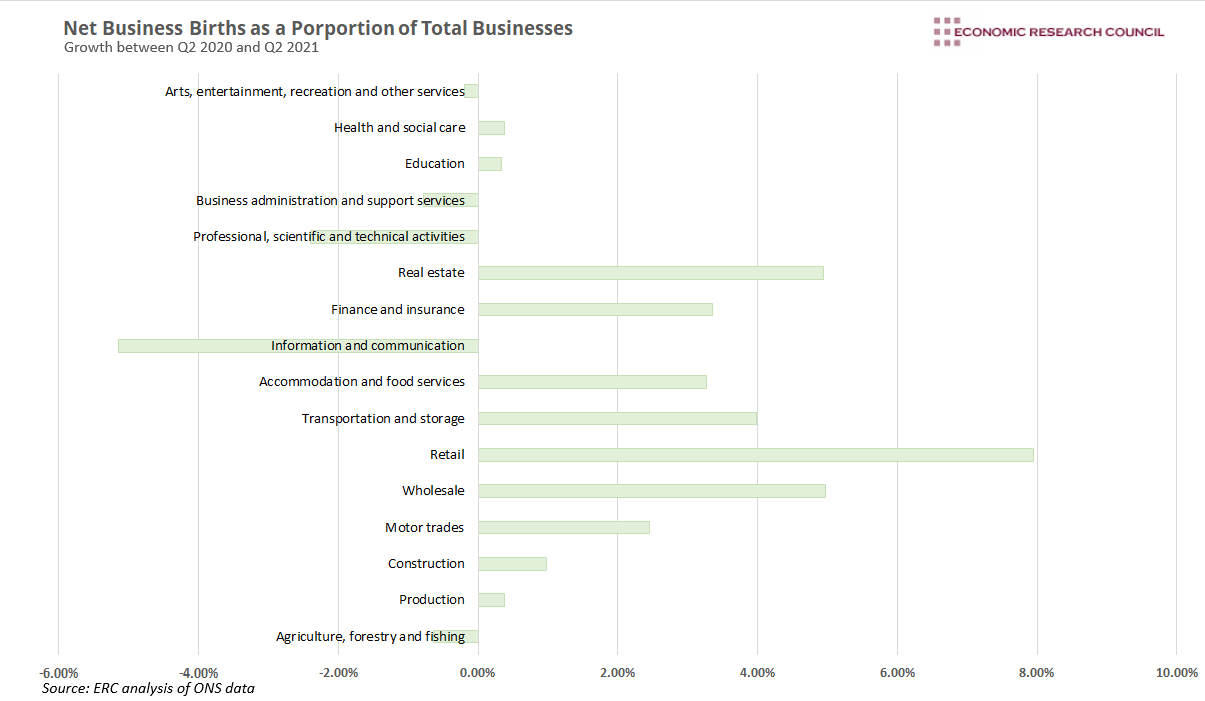

The chart displays the net increase in business registrations between Q2 2020 and Q2 2021, taken by subtracting business deaths from births for each SIC 2007 industry. The data is displayed as a percentage of the total number of businesses in each industry, to account for different sector sizes. Most industries have experienced net growth, with retail showing the strongest results. Information and communication, perhaps surprisingly, has performed worst.

Why is the chart interesting?

Through the course of the COVID-19 pandemic, much has been discussed about winners and losers throughout the economy. The enduring closure of hospitality venues, restrictions on construction work, as well as the relative success of online retailers have provided certain perceptions of the state of UK industries. Assessing business births and deaths provides another angle to test these perceptions, placing greater emphasis on the plight of smaller businesses that account for 60% of private sector employment in the UK.

Between Q2 2020 and Q2 2021, most industries increased in size, with the largest proportional increase of almost 8% occurring in retail. Despite businesses in the information and communication industry being most likely to adopt hybrid working, they experienced the greatest proportional loss of firms, with the size of the industry falling by 5.2% year on year. The industry had been thought of as a potential success story, due to the relative ease at which staff can work remotely, however the data above presents a different picture. Whilst business births in information and communication went through a period of fluctuation but ended up at a similar position to levels seen in Q2 2020, the industry has experienced significant deaths, with 12.8% of the number of firms in operation at the start of 2020 ceasing to exist by the end of Q2 2021.

Despite much discussed adversity, the retail industry has shown incredible resilience, with the number of firms growing by 7.9%. The government’s job retention scheme and business rates holiday has surely played a part in limiting business deaths in the sector, however a crucial factor in business growth has been the accelerated shift to online retail. In May 2021, online retail sales were up by 59% compared to February 2020. In-store sales had fallen by 1.3% during this period, despite a sharp increase in April once restrictions had been lifted. Online sales as a proportion of total retail sales grew from 19.9% in February 2020 to 28.5% in May 2021. Whilst this figure has fallen from its peak of 36.1% in February 2021, it nonetheless shows that consumers have been slow to move back to pre-pandemic retail habits. The growth in the number of businesses within the retail industry is largely reflective of the comments above. Analysis by Barclays suggests that 15% of retailers created roles specifically to boost their online capacity. The relative ease of establishing an online presence coupled with an increase in free time due to being on furlough/working from home has also encouraged smaller-scale retailers to join the market. Despite this, the extent to which these businesses last will in part be determined by the value at which online sales as a proportion of retail sales levels off in the coming months.

More broadly, the data above provides some promising insights. Of the five largest contributors to gross value added (GVA), only one industry (professional, scientific, and technical activities) has experienced a decline in the number of registered firms. Quarter on quarter data offers some caution, displaying more deaths than births altogether, as well as within four out of five of the largest contributors to GVA between April and June 2021. This most recent trend highlights the difficulty of establishing and maintaining a business, as well as the idea that some of these start-ups were only intended to operate over the short term. A continuation of the fall in quarterly net births combined with sustained economic growth will provide further evidence of these points.

By David Dike