Summary

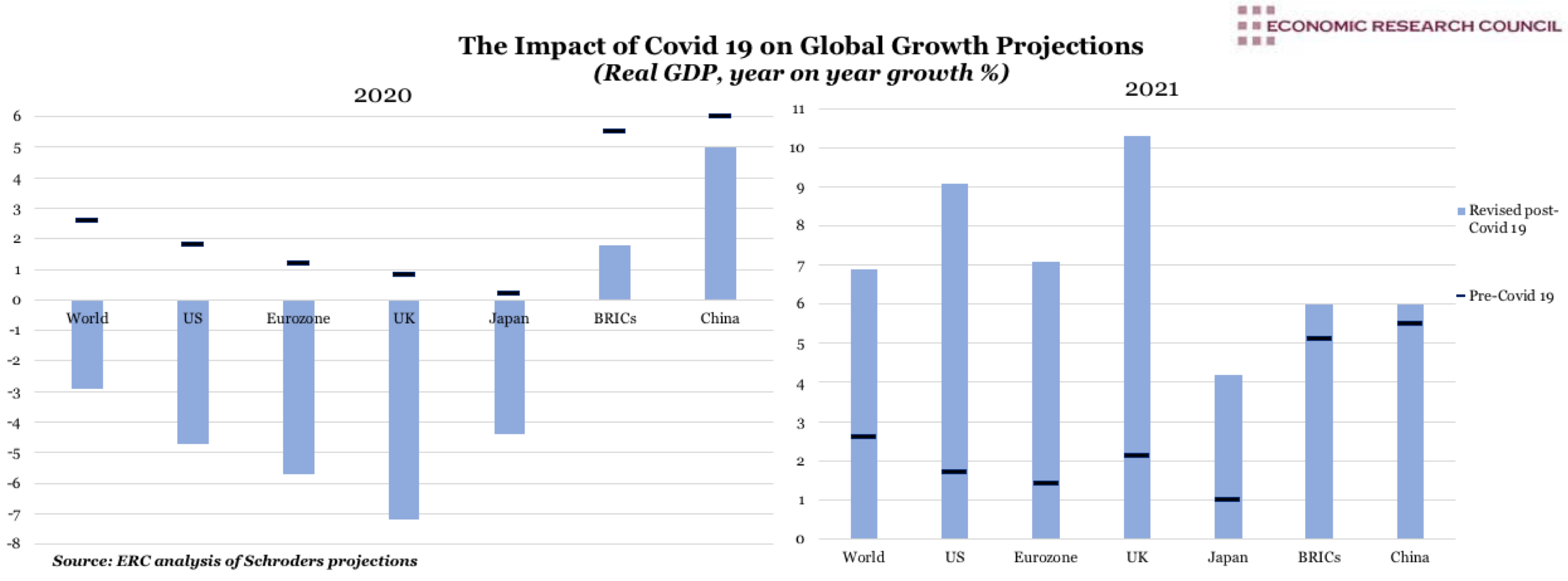

In late 2019, global growth looked set to rebound with business leaders ramping up activity. This optimism has now been shattered by the spread of Covid 19 and uncertainty about its duration. Outside China, the virus has been particularly devastating for Korea, Japan, Italy and Iran (where sanctions are further hampering recovery) but the situation remains fast developing, particularly in the US where a piecemeal, every-state-for-itself response is worrying many. As such, the chart shows severely downgraded global growth forecasts (from 2.6% to -2.9%)- making 2020 the worst year since the 1930s. The growth forecast globally for 2021 is 6.9%. The UK appears to be the hardest hit of the nations on the chart with a contraction of -7.2% in 2020 before a recovery of 10.3% in 2021. A full 1% has been wiped off Chinese growth forecasts in 2020 buoying the BRICs block of nations as the only others to escape full recession.

What do the charts show?

The charts display the impact of the global Covid 19 pandemic on the economic outlook. The bars display revised projections for growth in real GDP terms, measured as year on year growth in percent against the left-hand axis. The black bars denote pre-pandemic projections. The two charts display this data by country or region for 2020 and for 2021. The data is based on published predictions by Schroders. BRIC nations are Brazil, Russia, India and China.

Why is the chart interesting?

Whether the swift easing of monetary policy by central banks will be enough is still unknown although some observers are taking heart from the reduction in uncertainty via the easing of US-China trade tensions. Q1 growth in the US economy was already hampered by the cessation of 737 Max production at Boeing and, combined with the pandemic, has led to a downgrade of 2020 GDP growth from 1.8% to -4.7%. The US contributes over 25% of global output, so the imposition of shutdowns and travel restrictions will have wide-ranging global impact. On the other hand, in the first two months of 2020, the US had 3% growth (annualised) and this February, over a quarter of a million jobs were added to the market, so the country could have been facing the crisis in a weaker position. The drop in oil prices, usually a boon to growth, may be negated in the US by the energy sector halting capital expenditure in the face of collapsed consumer demand. However, countries that are net importers of oil may benefit, and net exporters (such as Norway, Russia and Mexico) stand to suffer from the price drop.

The authors of these forecasts cite their latest activity data from China, which indicates that retail sales contracted by one fifth and fixed capital investment by a quarter during the lockdown, contrary to official numbers. The recovery in China is to be closely observed, as Europe and the US remain a number of weeks behind in terms of the peak of the virus, although seemingly less capable of enforcing social distancing and lockdown measures. Falls in US and European GDP are expected within the 10-20% range, unprecedented in peace time.

As discussed in last week’s chart, the main objective needs to be securing those businesses whose income has been annihilated by the virus (particularly travel and hospitality) as any permanent cessation of business will delay any recovery. The Bank of England and the ECB have sought to incentivise banks to lend to SMEs via guaranteeing a percentage of loans and further assisting them via suspension of business rates. Regardless of any strongly-worded advice, the risk remains that banks will fail to offer rescue loans to distressed businesses without an explicit mandate. The US government will likely directly bailout airlines and cut income taxes alongside further cuts in the base rate from the Fed. As after the financial crisis, further QE measures are being deployed including corporate bonds for the first time. Keith Wade, Chief Economist at Schroders, says of this measure that this ‘may be more effective than rate cuts as it would help reduce stress in one of the key conduits of capital to the economy.’. However, it remains important that such measures do not artificially sustain already weak businesses, some of which have already buckled in the UK. The Italian economy is just as shaky as in the last crisis and there is a paucity of enthusiasm for austerity measures.

The recovery from 2008 and the dismantling of the debt bubble took years, and in terms of households, remains ongoing despite historically low interest rates. Regarding policy-makers’ current responses, Ian Stewart, the Chief Economist of Deloitte has said ‘Decisions have to be made on the basis of imperfect and changing information. This requires improvisation and an acceptance that most decisions will be imperfect, many will fail and some, even, will prove counter-productive… A national emergency robs decision makers of the luxury of time.’.

Indeed many of the policies implemented are open-ended and impossible to cost longterm, but the political cost of inaction is deemed far greater and the public seem in favour of large-scale state intervention on a range of issues. The US stimulus package amounts to almost 10% of GDP and the UK bonanza of public spending is estimated by the Financial Times to constitute 3% of UK GDP. As tax revenues diminish dramatically, deficits across the globe will rise to unprecedented levels with the support of even the most orthodox of laissez-faire economists in a total reimagining of classical doctrine. The global pandemic is also entering the roster of 21st century corporate risks- alongside climate change and cyber terrorism- for which companies must plan and prepare.

Summer is on the way and a reduction in the infectiousness of the virus is anticipated although not certain, with researchers from Imperial College London predicting that ‘transmission will quickly rebound if interventions are relaxed.’. If this causes reintroduction of measures, then a double-dip recession looms. Indeed, should the spread of the virus maintain this pace, a sustained decline is more likely, with the attendant loose fiscal and monetary policy lasting well into 2021.

Week 15, 2020