Summary

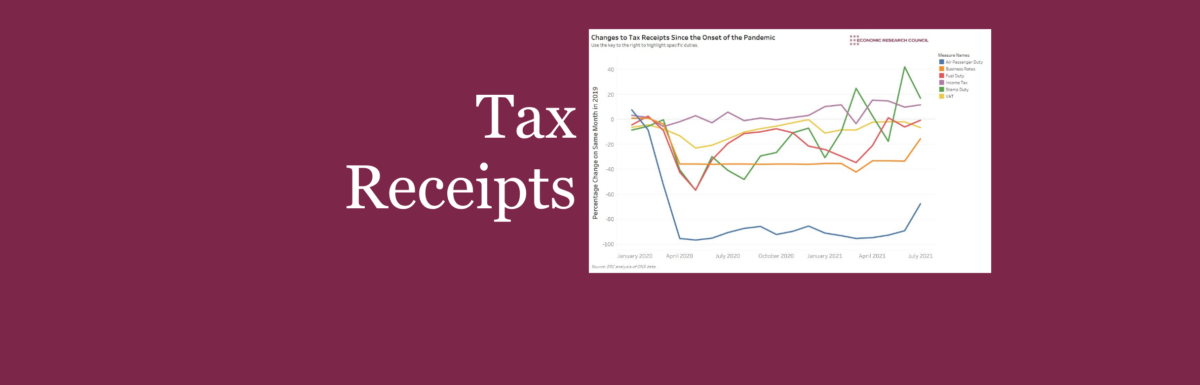

Tax receipts were pummelled due to lower economic activity associated with the COVID pandemic. This chart highlights the development of notable duties that together help to highlight the effect of the pandemic on government income. Use the key to highlight specific duties.

What does the chart show?

The chart tells a story of how government tax receipts have evolved over the COVID 19 pandemic. Six key categories are chosen to highlight the evolution of public finances during a financially difficult period for the government, showing tax receipts for each calendar month. Data points are compared to their equivalent month in 2019 to adjust for seasonal variations in taxation income.

Why is the chart interesting?

Air passenger duty has been an obvious casualty as the aviation industry ground to a halt due to restrictions on foreign travel. The number of people flying fell by 93.6% at its trough. This was reflected in a 76.3% reduction in receipts in 2020, leaving government finances short of £2.9bn. Restrictions on foreign travel have also been accompanied by a reluctance to travel, with 72% of British people suggesting they have no intention to take a flight in the near future, according to a recent YouGov poll. The loss of activity has led to calls for the government to scrap air passenger duty, with Michael O’Leary, Chief Executive of Ryanair, suggesting that a 2-3 year suspension in the duty could save the aviation industry. After stalling at less than 80% of pre-pandemic levels for most of the last year and a half, air passenger duty receipts have started to improve since June, owing to the easing of lockdown restrictions, and increased vaccine confidence, though it has some way to go before reaching 2019 levels.

The Chancellor announced a temporary 100% business rates relief for retail, hospitality and leisure businesses, which took effect in April 2020. Prior to this, receipts had fallen by around 8% compared to 2019. Between April 2020 and June 2021, receipts remained relatively steady, suggesting the relief had been successful in keeping retail and hospitality venues in business. June saw business rate relief fall to 66%, resulting in an increase in receipts. As the pandemic has accelerated a shift towards online retail, the business rates relief potentially presents a window of opportunity to those who have long been calling for reform, with chief executives of British businesses such as Tesco and Waterstones pressing this issue to the Chancellor ahead of the last budget.

Fuel duty highlights an obvious consequence of lockdown: reduced travel. Each inflection point on the chart (February 2020, May 2020, October 2020, March 2021), is exactly on, or very close to the imposition or easing of restrictions. An interesting point is the depth of the reduction in the first lockdown compared to the second. Fuel duty was 57% below pre-pandemic levels in May 2020, compared to only 35% in March 2021. As the chart displays, receipts are now roughly back up to pre-pandemic levels.

Quite remarkably, income tax receipts have shown incredible resilience during the pandemic. Through the stricter periods of lockdown early on, receipts hovered between +/- 5% compared to the same period in 2019, before rising in January 2021. Government support schemes have resulted in lower than expected unemployment figures and subsequently boosted tax receipts. Coupled with this, wage growth has also been strong, with annual growth in total pay rising by 8.8% in June. All is not what it seems, however, as the strong wage growth has largely been as a result of a fall in the number of low paid jobs over the course of the pandemic. A reduction in the number of jobs paying below the personal allowance leading to an increase in average wage rates is one factor leading to relatively strong income tax receipts.

Stamp duty has been ever-present in the media through the pandemic, due to the increase in the nil rate band that came into force in July 2020. Unsurprisingly, the data shows a clear correlation between key moments associated with the policy and receipts. Between March and May 2020, receipts tumbled as house viewings were deemed non-essential. The government’s reversal of this advice encouraged activity in the market and improved tax receipts, though they were still almost 30% lower in June 2020 compared to the year before. The increase in the nil-rate band which took effect in July 2020 steadily increased tax receipt (excluding the usual slump that occurs around Christmas). Despite this, throughout the crisis stamp duty receipts remained lower than equivalent months in 2019 for each month until March 2021, where it increased by a quarter compared to pre-pandemic levels. Interestingly, the only months in which stamp duty receipts were higher than pre-pandemic levels were March, June, and July 2021, coinciding with the initial end of the stamp duty holiday, and the revised end of the policy prior to the taper beginning. Total stamp duty receipts between January and July 2021 were £300m greater than at the same time in 2019, indicating the holiday has been a success. However, recent analysis by HMRC has shown that house sales fell by near two thirds in July, which will certainly put downward pressure on August receipts, and possibly months after that.

VAT receipts followed a similar path to other duties affected by successive lockdowns, most notably fuel duty. After the third lockdown, it sat just below pre-pandemic levels. Despite the notable trend, analysis by the Office for National Statistics presents more interesting points. Namely in March 2021, the number of firms sending VAT returns for the first time increased to the highest level since August 2016. A continuation of this would signify increased confidence and hopefully indicate strong future growth.

Overall, despite large, sustained reductions in tax receipts, we are starting to see receipts move in a direction towards pre-pandemic levels. Indeed some, such as stamp duty and income tax, have already surpassed these. Reaching, and staying above pre-pandemic levels will not only provide the government with room to manoeuvre after significant expansionary fiscal policy but will also offer hope that the worst, at least economically, is behind us.

By David Dike