Summary

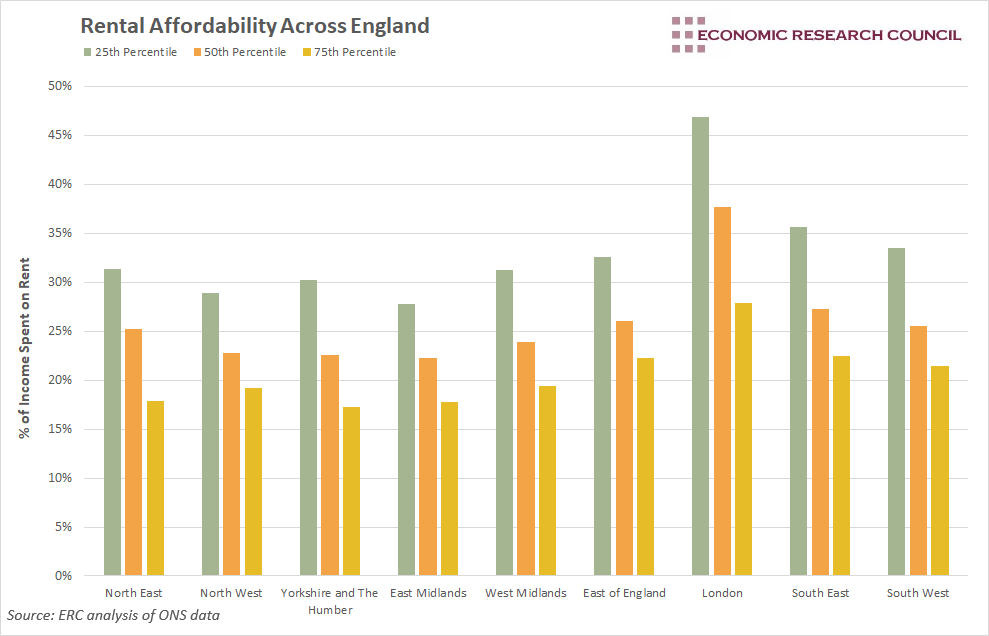

This week’s chart asks ‘is it affordable for people to rent a property that their level of income would dictate?’. The extent to which they can varies considerably across the country, with London, naturally, being least affordable. We show that this isn’t just an issue for those on lower incomes.

What does the chart show?

The chart displays the affordability of rental accommodation in each region of England. It shows the proportion of income that people would need to spend to rent certain types of property. The ‘50th percentile’ refers to the percentage of income spent by households earning a level of income at the 50th percentile, renting a property where rent is priced at the 50th percentile. Essentially, it assesses the affordability of a middle-income household renting a mid-priced property in their region. The same logic follows for the 25th and 75th percentile.

Why is the chart interesting?

Higher incomes allow for increased standards of living. This is reflected in this week’s chart, as it aims to take a nuanced understanding of affordability, essentially asking how much it costs to rent a property that allows households to achieve a standard of living that aligns with their income. Wealth is a factor that can enable households in a particular income percentile to comfortably rent property priced at a higher percentile, however, this effect is expected to be minimal given the likelihood of wealth being held in property thus negating the need to rent. In order to judge affordability, we utilise the Office for National Statistics’ approach, deeming a property affordable if less than 30% of gross income is spent on rent.

The chart paints a worrying picture for lower-income (25th percentile) households across England. The only regions where they can affordably rent property to achieve a standard of living their income would dictate are the North West and East Midlands. In every other English region, low-income earners would need to spend over 30% of their gross income on rent. As expected, London is the least affordable, with low-income households spending 47% of their gross income on rent to achieve a satisfactory standard of living.

The picture looks better for median income (50th percentile) households in most regions of England, where renting a property to achieve a suitable standard of living costs below 30% of gross income. The one exception here is London. For higher-income households, each region offers affordable rental prices.

Assessing household income levels helps to put the above into context. The data utilises total monthly household income for private renters to calculate affordability. In London, the 25th percentile was £2,470 (£29,640 p/a), the 50th percentile stood at £3,780 (£45,360 p/a), whilst the 75th percentile was £6,605 (£79,260 p/a). This goes a long way to highlight the issues that single Londoners face in the rental market. A recent YouGov report suggested that fewer than half of the people in Britain expect to earn a yearly salary over £30,000 at any point in their lifetime. If individuals manage to achieve this level of income in London, renting accommodation can take almost half of their pre-tax income, making saving and discretionary spending increasingly difficult. Even when individuals manage to earn £45,000 p/a, renting in London still isn’t affordable, by the ONS definition. A common solution to this is to pool resources, either through renting with a friend, or in a house share. Whilst widespread, it is a damning indictment of the situation of the London housing market. Young, single professionals are faced with a catch-22: pay unaffordable rent and don’t save in order to live in a reasonable flat, rent a room and slowly accumulate savings over a number of years, or live somewhere more affordable where job prospects are reduced. Is this the best we can do?

By David Dike