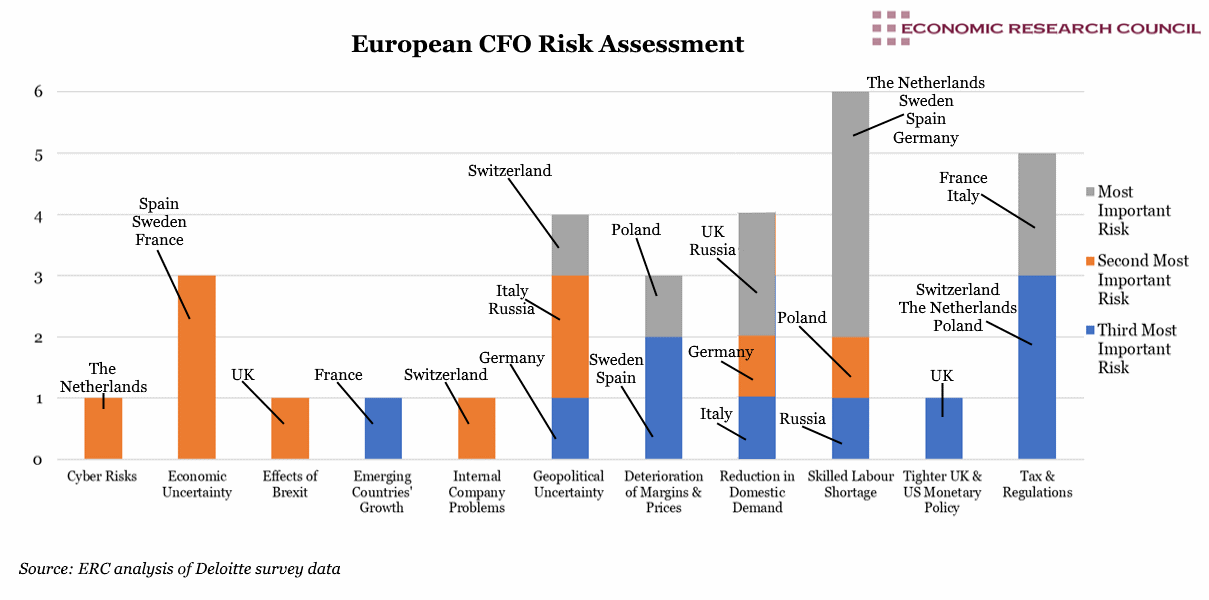

Summary

The chart shows that skills shortages in the work force are the leading concern for CFOs across Europe. Three of the ten largest economies highlighted cited concern over the economic outlook, with the survey producers stating that this is has been a growing trend over the last five years. Seemingly, this indicates that this is an issue worrying business leaders regardless of the economic climate. The number of nations where CFOs were wary of a downturn was more pronounced in the wider survey (6 out of 20 nations cited it as a top-three risk). This is echoed by the anxiety over reduced domestic demand. Concern over increased tax and regulation is a relatively regular feature of running a business, although the high level of risk associated with geopolitical uncertainty is notable.

What does the chart show?

The chart shows the results of a survey of Chief Financial Officers of companies headquartered in European countries from a wide range of sectors. The question asked was ‘Which of the following factors are likely to pose a significant risk to your business over the next 12 months?’ and respondents were asked to select three options in order of priority.1,652 CFOs across 20 European nations were polled between February and April 2018. The chart displays the top three risks identified by CFOs of the 10 largest economies within the cohort. The factors that were not selected by CFOs from the countries shown were: erosion of competitive position in the market, currency fluctuations, domestic interest rates and rising labour costs.

Why is the chart interesting?

The chart shows that CFOs of the largest European nations, excluding the UK, do not express explicit concern about the effects of Brexit. The effects of leaving the European Union are cited as important by UK CFOs, but many of the anticipated implications of the process straddle a number of other risk categories, for example skills shortages and changes in regulation. Similarly, the effect of tightening monetary policy from the Bank of England and the Fed does not concern the CFOs of any European businesses, who are not reliant on cheap dollar/pound borrowing and clearly think the ECB will not follow suit any time soon.

Only CFOs in the Netherlands were concerned about cyber security, perhaps reflecting their government’s drive to increase awareness of this. According to Eurostat, only the Czech Republic is safer than the Netherlands for internet users.

Geopolitical uncertainty is a fairly obvious risk on the horizon as sanctions on Russia remain in place; trade wars have been threatened between China, the EU and the United States, the Turkish and Italian crises continue and ‘no-deal’ Brexit sentiment increases.

Week 34, 2018