We critically examine the Conservative Party’s “Triple Lock Plus” policy, which proposes increasing the tax-free personal allowance for pensioners in line with the highest of earnings, inflation, or 2.5%. While the policy aims to provide financial security for retirees, it raises significant concerns about intergenerational equity and long-term economic sustainability. We explore the potential costs, benefits, and trade-offs of the policy, considering its impact on different income groups among pensioners and the broader societal implications. Additionally, we discuss alternative approaches that could address these concerns while ensuring a fair and sustainable pension system for all generations.

Introduction

The Conservative Party’s recent announcement of their “Triple Lock Plus” policy has generated significant debate in the lead-up to July’s general election. This policy promises to increase the tax-free personal allowance for pensioners in line with the highest of earnings, inflation, or 2.5%, mirroring the existing triple lock on state pensions. The stated goal is to ensure that pensioners’ tax-free income rises each year, providing financial security for retirees.

However, this policy raises critical questions about intergenerational equity and long-term economic sustainability. While it offers immediate benefits to pensioners, it may impose significant costs on future taxpayers and create disparities between different age groups. As we delve deeper into the economic implications of the Triple Lock Plus, it is essential to understand its potential impacts on both current and future generations, considering the broader context of the UK’s pension system and fiscal policies.

Understanding the Triple Lock Plus Policy

The “Triple Lock Plus” policy proposed by the Conservative Party seeks to extend the principles of the existing triple lock on state pensions to the income tax personal allowance for pensioners. The triple lock mechanism, introduced in 2011, ensures that the state pension increases annually by the highest of three measures: average earnings growth, inflation, or a minimum of 2.5%. This policy has been instrumental in raising the state pension substantially over the past decade.

Under the proposed Triple Lock Plus, the personal allowance for pensioners—currently set at £12,570—would similarly rise in line with the highest of earnings growth, inflation, or 2.5%. The intent is to ensure that the tax-free threshold for pensioners keeps pace with the increases in the state pension, thereby preventing pensioners from being drawn into paying income tax as their state pension rises.

To appreciate the significance of this proposal, it’s important to understand the historical context. Since 2010, the state pension has seen substantial growth due to the triple lock. For instance, between 2010-11 and 2023-24, the state pension increased by approximately 60%. During the same period, pensioners’ income tax allowance was effectively reduced in real terms, leading to an increase in the proportion of pensioners paying income tax. In 2010-11, the personal allowance for those aged 65 to 75 was £9,490, compared to £6,475 for those under 65. However, this higher allowance for pensioners was abolished under the Coalition government.

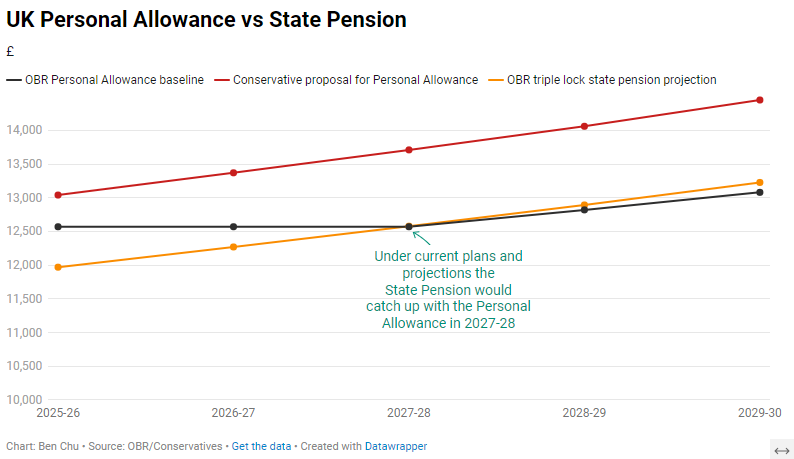

The state pension will stand at around £11,542 per year, while the income tax personal allowance is £12,570. With the personal allowance frozen and the state pension continuing to rise due to the triple lock, it is projected that the state pension will exceed the personal allowance within the next few years, bringing more pensioners into the tax net. The Triple Lock Plus aims to prevent this by ensuring the personal allowance increases at the same rate as the state pension.

Source: Ben Chu (BBC)

When compared with international pension policies, the UK’s triple lock is relatively generous. Many other developed countries index their pensions to either inflation or wages, but not both. For example, in Germany, pensions are indexed to wage growth, while in Japan, they are linked to a combination of prices and wages but with a more modest increase. By extending the triple lock mechanism to the personal allowance, the UK would further differentiate its pension policy from these international norms.

Economic Analysis

The Conservative Party estimates that the Triple Lock Plus policy will cost £2.4 billion per year by the end of the next parliament. This cost arises from increasing the personal allowance for pensioners in line with the highest of earnings, inflation, or 2.5%, rather than allowing it to remain frozen. A substantial portion of this cost, approximately half, stems from avoiding planned tax increases for pensioners by maintaining the personal allowance at its current level in real terms.

To fund this policy, the Conservatives propose enhancing tax collection and cracking down on tax avoidance and evasion. They estimate that these measures will raise an additional £6 billion annually. However, the effectiveness and reliability of these measures are uncertain and may not fully cover the projected costs. Enhancing tax collection often requires substantial investment in administrative capacity and can face legal and practical challenges.

A critical concern with the Triple Lock Plus is its long-term sustainability. The policy essentially ties a significant portion of the tax system to the triple lock mechanism, which has already significantly increased the cost of state pensions. The government currently spends around £11 billion more annually on state pensions due to the triple lock compared to what it would have spent if pensions had only risen with earnings since 2010.

By extending the triple lock to the personal allowance, the government would increase the complexity and potential cost of the tax system. Economic volatility, such as high inflation or significant wage growth, could lead to substantial and unpredictable increases in the personal allowance, further straining public finances. The cumulative effect of such increases over time could lead to a growing fiscal burden, potentially requiring future tax increases or spending cuts in other areas to maintain budgetary balance.

Implementing the Triple Lock Plus involves significant economic trade-offs. While it provides immediate financial benefits to pensioners, it may necessitate higher taxes or reduced spending in other areas in the future. This policy could also exacerbate intergenerational inequities, as younger taxpayers may bear the long-term costs of sustaining higher personal allowances for pensioners.

Moreover, the focus on pensioner benefits may divert resources from other critical areas, such as education, healthcare, and infrastructure, which are essential for the broader economic health and future prosperity.

Effects on Pensioners

The primary beneficiaries of the Triple Lock Plus policy would be pensioners who receive the full new state pension and have additional sources of income that could otherwise push them into the taxable bracket. With the state pension currently around £11,542 per year and the personal allowance set at £12,570, even modest additional income can result in pensioners paying income tax. By increasing the personal allowance in line with the triple lock, the policy aims to keep more pensioners below the tax threshold, thus reducing their tax burden.

- Pensioners with incomes close to the state pension level would benefit significantly from the policy. These individuals would see their tax-free income rise, potentially lifting them out of the tax net entirely. For example, a pensioner receiving only the state pension and a small private pension or savings income would benefit from the increased allowance, ensuring they remain tax-exempt.

- Those with moderate additional incomes would also benefit, as the higher personal allowance would reduce their taxable income, leading to lower tax liabilities. This group includes pensioners with larger private pensions or part-time earnings that supplement their state pension.

- The wealthiest pensioners, who already have significant taxable incomes, would benefit less proportionally. While they would still see a reduction in their taxable income, the overall impact on their tax burden would be smaller compared to lower-income pensioners.

Since the introduction of the triple lock in 2011, pensioners have generally seen their incomes rise. The state pension has increased by 60% between 2010-11 and 2023-24, outpacing inflation and average earnings growth. This has significantly improved the financial situation of many pensioners, particularly those in the lower and middle income brackets.

According to the Resolution Foundation, most pensioners have experienced real-terms income growth since 2010, with the poorest groups seeing a 3.9% increase, equivalent to around £754 per year. In contrast, the wealthiest 5% of pensioners have seen a 1.6% decrease in their incomes, amounting to £1,832 per year, after adjusting for inflation. This divergence highlights the varying impacts of pension policy changes on different income groups.

Despite the overall positive trend, recent changes have had a more negative impact on pensioner incomes. The freezing of income tax thresholds, coupled with rising state pensions, has meant that many pensioners are now paying more tax. During the current Parliament, all but the poorest pensioners have seen reduced incomes due to these factors. The Resolution Foundation notes that pensioners in the top 20% of the income distribution have seen their incomes fall by £3,100, while those in the bottom 20% have experienced a modest increase of £170 due to means-tested benefits.

Intergenerational Equity

One of the most contentious aspects of the “Triple Lock Plus” policy is its impact on intergenerational equity. While the policy aims to protect pensioners from tax increases, it raises significant concerns about fairness between different age groups.

Triple Lock Plus would prevent more pensioners from falling into the tax net as their state pensions increase. However, the personal allowance for working-age individuals is currently frozen at £12,570 until at least 2027-28. This disparity means that while pensioners would see their tax-free income rise, working-age individuals would face a relatively higher tax burden over time as inflation and earnings growth erode the real value of their personal allowance.

Historically, pensioners enjoyed a higher tax-free allowance than working-age people. For example, in 2010-11, the personal allowance for those aged 65 to 75 was £9,490 compared to £6,475 for those under 65. This higher allowance was abolished under the Coalition government, and since then, the real value of pensioners’ income tax allowance has decreased by more than 10%, while the allowance for working-age people has increased by 30%, even after recent freezes.

The policy’s focus on increasing the personal allowance for pensioners at a faster rate than for working-age people raises questions about fairness. Younger taxpayers, who may already face significant financial pressures such as student loans, housing costs, and childcare expenses, could perceive this policy as disproportionately benefiting older generations. This perception could foster resentment and contribute to intergenerational tensions.

Moreover, the long-term economic consequences of this policy could be significant. By tying the personal allowance to the triple lock mechanism, the government commits to potentially large and unpredictable increases in the tax-free threshold for pensioners. This could result in substantial revenue losses for the Exchequer, necessitating higher taxes or spending cuts elsewhere to maintain fiscal balance. Younger generations may ultimately bear the cost of these adjustments, either through reduced provision of public services or increased tax burdens.

The broader societal implications of favouring one generation over another cannot be ignored. As the population ages, the number of pensioners relative to working-age individuals is increasing. This demographic shift places additional strain on public finances, as fewer workers are available to support a growing number of retirees. Policies that disproportionately benefit pensioners at the expense of younger generations could exacerbate these pressures, leading to unsustainable fiscal policies and social instability.

To address intergenerational equity concerns, policymakers could consider alternative approaches that provide targeted support to the most vulnerable pensioners while ensuring that tax policies do not disproportionately favour any single age group. For example, means-tested benefits could be enhanced to support low-income pensioners without extending broad tax advantages to all retirees.

Additionally, gradually aligning the personal allowance increases for both pensioners and working-age individuals could help distribute the tax burden more evenly across generations. Such an approach would require careful planning and clear communication to ensure public understanding and acceptance.

Alternative Ideas

To address concerns about intergenerational equity and economic sustainability, several alternative approaches could be considered:

- Means-Tested Benefits: Enhancing means-tested benefits for low-income pensioners could provide targeted support without extending broad tax advantages to all retirees. This approach would ensure that resources are directed to those who need them most while maintaining fiscal responsibility. Placeholder: Obtain data on the effectiveness of means-tested benefits in reducing pensioner poverty.

- Gradual Alignment of Allowances: Aligning the increases in personal allowances for both pensioners and working-age individuals over time could help distribute the tax burden more evenly. This gradual approach would require careful planning and clear communication to ensure public understanding and acceptance.

- Indexing to a Single Measure: Instead of using the triple lock, indexing both state pensions and personal allowances to a single measure, such as inflation or average earnings, could simplify the system and make it more sustainable. This approach would reduce the volatility and unpredictability associated with the triple lock mechanism.

- Strengthening Workplace Pensions: Encouraging greater participation in workplace pensions and enhancing the auto-enrolment scheme could provide long-term financial security for future retirees. By focusing on building robust private pension systems, the reliance on state pensions could be reduced, easing the fiscal burden on the government.

- Intergenerational Funds: Establishing intergenerational funds that invest in public infrastructure and social programs could help balance the needs of different age groups. These funds would aim to provide returns that benefit both current pensioners and future generations, promoting equity and sustainability.

Conclusion

While the Triple Lock Plus offers immediate financial relief to pensioners, it poses significant challenges in terms of intergenerational equity and long-term economic sustainability. The policy’s benefits for pensioners must be weighed against the potential costs and impacts on younger generations, who may face increased tax burdens and reduced public services as a result.

Policymakers must consider these trade-offs carefully, striving to develop a balanced approach that supports vulnerable pensioners without disproportionately benefiting one generation at the expense of another. Alternative approaches, such as enhancing means-tested benefits and gradually aligning personal allowances, could provide a more equitable solution.

As the UK approaches the general election, it is crucial for voters and policymakers to engage in informed discussions about the implications of pension policies like the Triple Lock Plus. By considering the broader economic and social context, the UK can work towards a pension system that ensures fairness and sustainability for all generations.