Summary

This week’s chart uses payment data to assess how people have reacted to the cost-of-living crisis this year. Whilst a squeeze is evident, people seem to be more willing to spend their money on activities that enable human interaction.

What does the chart show?

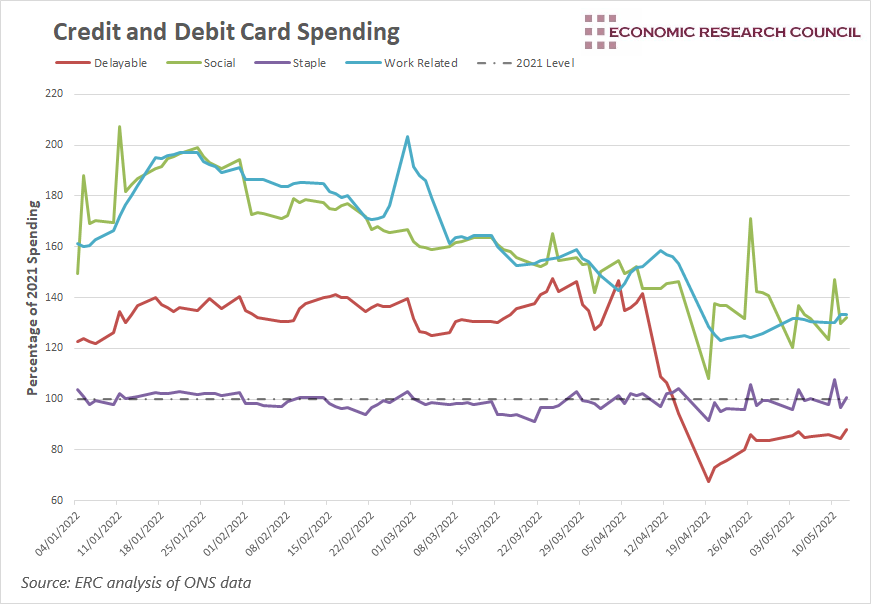

The chart shows experimental faster indicators of UK spending on credit and debit cards. The data displayed is the number of transactions on a given day, as a percentage of the same day last year. It tracks daily CHAPS payments made to around 100 large UK organisations. Payments are categorised into delayable (red), social (green), staple (purple) and work-related (blue). Work-related expenses largely refer to commuting payments.

Why is the chart interesting?

With inflation running at its highest level in 40 years, this week’s chart assesses the spending decisions of UK citizens since the start of the year. Seasonal fluctuations in spending decisions mean that simply charting spending in each category over time does not provide many useful inferences. Instead, this year’s spending as a proportion of spending on the same day last year is used. One word of caution, however, is that as the chart assesses CHAPS payments from a specific list of retailers, the data fails to capture many electronic payments, as well as all cash payments. This second point means that the chart may fail to accurately reflect the spending of the poorest in society, who tend to rely more on cash.

Throughout the start of the year, spending on staple goods has remained near 2021 levels, moving between the range of 90-110% of 2021 spending. Despite this, since February, daily spending on staple goods has been lower than in 2021, indicating that people may be cutting back slightly due to increases in the cost of living.

As the chart displays, changes in social and work-related spending compared to last year follow each other well and are directly linked to changing government advice in the early periods of 2021, meaning the chart largely reflects base effects. In January, England entered into a third lockdown. The end of February saw the PM develop a roadmap for lifting lockdowns, and schools reopened fully in March. Non-essential retail then reopened in April. The tightening of restrictions in early January allowed social and work-related spending in January 2022 to rise relative to 2021. The easing of restrictions between February and March 2021 saw social and work-related spending in 2022 fall relative to last year. The one aspect of the chart that is explained by factors other than base effects is the end of February 2022, when work-related spending spiked compared to 2021. This was directly caused by the end of Covid isolation laws associated with the Omicron virus and saw a large, but unsustained increase in work-related (commuter) spending.

The change in spending on delayable goods again reflects base effects. During the period up to April, non-essential retail shops were closed in 2021, depressing spending on delayable goods, hence the increase in 2022 relative to 2021. The reopening of non-essential retail in 2021 gave people an opportunity to spend some of the money they had saved over the pandemic. Spending on delayable purchases this April failed to match the huge rise we saw last year. In addition to this, cost of living concerns may increase the magnitude of the fall relative to 2021. Despite this since the middle of April, spending on delayable goods has been increasing relative to last year. Unfortunately, this isn’t the cause for optimism, as base effects yet again drive the data. The large increase in spending on delayable goods in 2021 reflected consumers bringing forward purchases that would otherwise have been done later in the year, due to the reopening of non-essential retail. Whilst spending on delayable purchases has fluctuated slightly since April, it is the only category in the chart that has failed to reach pre-pandemic levels on any day in April and May so far.

Interestingly, taking an average of the last week of available data, spending in each category apart from delayable spending is not just above 2021 levels, but also above pre-pandemic levels. As such, the effects of the squeeze on costs of living have varied based on the spending category. It seems quite clear that social and work-related spending is being prioritised over delayable spending, which is understandable after an extended period of isolation.

By David Dike