Summary

The stamp duty holiday came during a beleaguered housing market when consumers were low on confidence. This week’s chart assesses the effect that the holiday had on the housing market, as well as the wider economy.

What does the chart show?

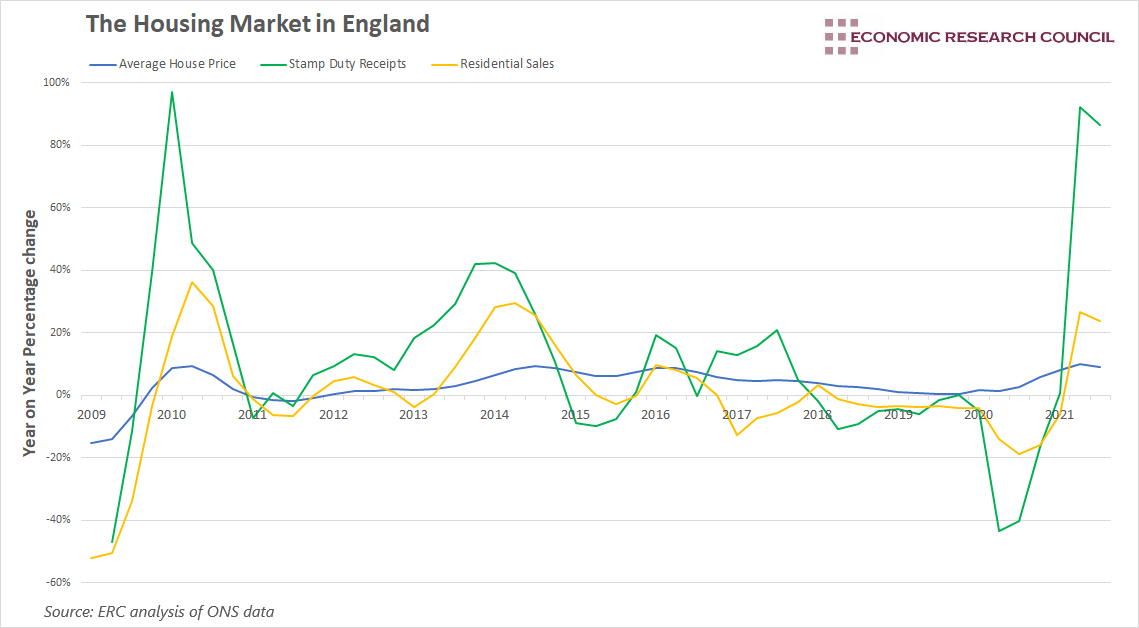

The chart shows the year-on-year growth rates of average house prices in England (blue), stamp duty receipts (green), and residential sales (yellow) in each quarter from 2009 to 2021.

Why is the chart interesting?

The stamp duty holiday was looked favourably upon by many movers, at a time when the housing market had ground to a halt and at the beginning of the Covid-19 pandemic. It came into force with dual aims. Firstly, it sought to stimulate the housing market at a time of low confidence and plummeting house sales. In addition to this, it also sought to increase expenditure related to housing transactions, such as furnishing and solicitors’ services. The first aim was supposed to be achieved by reducing the purchase costs for most people and convincing many people to bring forward purchasing plans, whilst the second aim would be achieved by freeing up funds for people to spend on improvements to the property that they buy. The analysis below assesses these aims, as well as the unintended consequence of increasing house prices.

In the 4 years leading up to 2020, England saw a positive, but falling year on year rate of growth in average house prices, with a peak of 9.5% growth at the start of the period. At the same time, residential sales experienced a downward trend, indicating that a deceleration in demand allowed house prices to grow at a slower rate.

Another feature of the chart is that through the majority of the time period analysed, stamp duty receipts tended to rise at a faster rate than residential sales. This usually occurs when average house price growth is accelerating, indicating that a faster rise in house prices is encouraging a faster rise in stamp duty receipts relative to residential sales.

The stamp duty holiday came into effect in July 2020, and the effects began to be apparent in September of that year. We can see from the chart that after a dismal start to 2020, Q3 acts as an inflection point for residential sales. Analysis by the LSE suggests that 40,000 additional transactions were made between September 2020 and January 2021, directly as a result of the holiday, with an additional 100,000 made between then and June 2021. Their research also found that movers spent around £6,000 on moving expenses, and expected to spend a further £10k – £20k on average in the first year on their new property. This would suggest that the stamp duty holiday was responsible for an additional £1.8bn – £2.7bn in spending.

House prices in England rose by 10% in Q2 2021 compared to the year before. Prices had only risen by 1.25% when comparing Q2 2020 to Q2 2019. This 10% rise is a factor in the 92% year on year increase in stamp duty receipts, especially as residential sales only rose by 26%. The chart does seem to suggest that the announcement of the stamp duty holiday in July 2020 encouraged a notable uptick in residential sales from September, though house prices were accelerating since the announcement in July.

Of course, as with everything, the reality is more nuanced. It is likely that market-based factors and the increased confidence around covid played a part during the period, but timings in the changes of residential sales certainly seem to point to a prominent role for stamp duty.

By David Dike