Summary

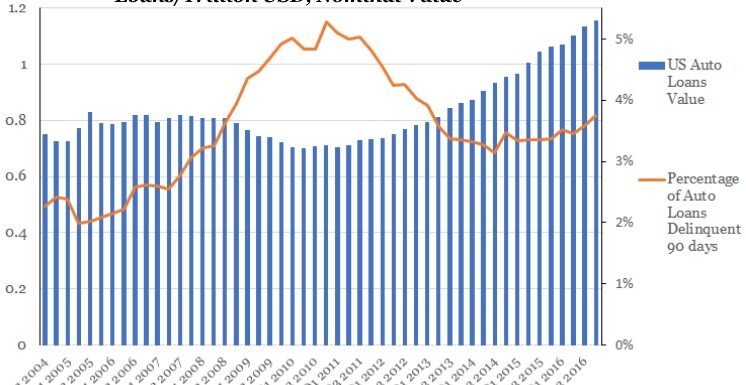

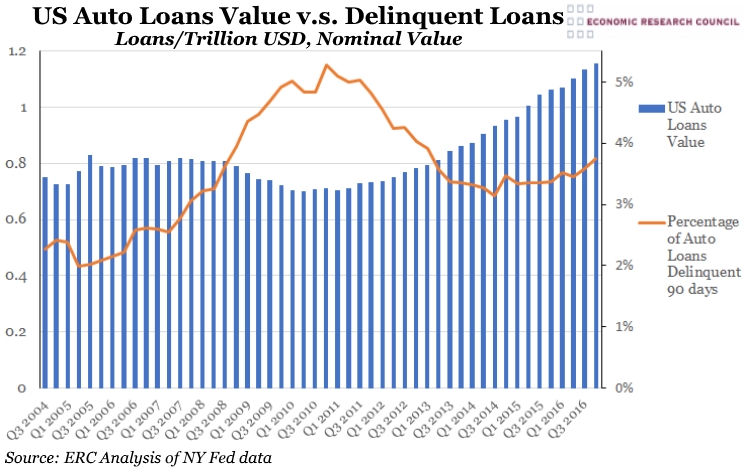

The charts show the nominal value of car loans issued in the US, which peaked at $1.157 trillion in 2016, representing a 65% increase since 2004. Between 2004 and 2008, the value of loans remained fairly stable, whilst delinquency grew steadily. However, following the global crash in 2008, one can see a clear drop in the value of loans issued, as well as a spike in delinquency, which reflects the efforts of US financial institutions to clean up their balance sheets. This prudence only lasted until 2010, when the value of car finance loans began to steadily increase once again. The value of delinquent loans has grown from $17 billion in 2004 to $43 billion in 2016, an increase of nearly 155%.

What do the charts show?

The blue bars in the first chart display the total, nominal value of all loans issued against cars on the road in the US in trillions of US dollars. The data runs from 2004 to year-end 2016 and is measured against the left hand axis. The orange line represents the percentage of these loans which are considered ‘delinquent’, i.e. four missed payments or unpaid 90 days after the due date. This is measured against the right hand axis. The second chart displays the real nominal value of these delinquent loans over the same period, in billions of US dollars.

Why are the charts interesting?

The increase in delinquency reflects the growing use of in-house financing by US car manufacturers; which, due to the incentive of growing their sales, are increasingly being issued to clients of poorer credit quality. The Federal Reserve Bank of New York estimates that manufacturer-underwritten loans account for 75% of all loan delinquency and contrasts this to loans issued by banks and credit unions, who have experienced reductions in bad loans since the financial crash. The ready availability of new car finance has encouraged consumers to not only opt for new cars over used ones, but also to choose more expensive models, with longer financing periods, as the difference in monthly payments can seem insignificant. Loans are based on the resale value of the used model, however many automotive experts predict the second-hand car market to be in decline, largely due to the increase in new-car incentives offered by manufacturers and the resultant influx of younger used cars onto the market. Although delinquency is rising on car loans it still lags behind delinquency on both student and credit card debt in the US.